Special Research on High Temperature Alloy Industry

1. High temperature alloy: cutting-edge industrial material

High temperature alloy, also known as heat-resistant alloy or superalloys, refers to an alloy material based on iron, nickel, and cobalt that can resist oxidation, corrosion, and creep at high temperatures above 600 ℃, and can work for a long time under high mechanical stress. Based on the above performance characteristics, high-temperature alloys are currently a cutting-edge industrial material standing at the top of the pyramid. They are not only key materials for hot end components of aviation engines and various high-temperature components of aerospace rocket engines, but also widely used in industrial sectors such as gas turbines, energy, and chemical engineering.

High temperature alloys can be divided into iron-based high-temperature alloys, nickel based high-temperature alloys, cobalt based high-temperature alloys, etc. according to the type of matrix element. Among them, nickel based high-temperature alloys have relatively stronger heat resistance, so they are the most widely used, accounting for up to 80% of current production; According to the manufacturing process, it can be divided into deformed high-temperature alloys, cast high-temperature alloys, and powder high-temperature alloys.

1.1 Deformable high-temperature alloys

Deformable high-temperature alloys refer to high-temperature alloys produced through casting deformation processes, which can undergo cold and hot deformation processing, have good mechanical properties, good strength and toughness, and high oxidation resistance. They include products such as disks, plates, rods, wires, strips, and tubes, and are the most widely used type of high-temperature alloys in the market, accounting for 70% of the demand.

At present, the main models in China include GH4169, GH4738, GH128, GH4065, GH4068, etc. Among them, GH4169 is known as the "King of Deformable High Temperature Alloys" and is benchmarked against BO7718 from the United States. Its yield strength below 650 ℃ ranks first among deformed high-temperature alloys, making it the most widely used and widely used high-temperature alloy variety in China. The main grades of deformed high-temperature alloys have a nickel content between 50% and 60%, with GH4169 having a nickel content of about 53%, GH4065 having a nickel content of about 55.5%, and GH4738 having a nickel content of about 58.7%.

The domestic deformation high-temperature alloy field has formed a complete industrial chain from research and development to products, with production processes involving raw alloy melting, precision forging, etc.

1.2 Casting high-temperature alloys

Casting high-temperature alloys refer to a type of high-temperature alloy that can or can only be molded into parts using casting methods. Compared with deformed high-temperature alloys, it has a higher degree of alloying and is difficult to deform during hot working, so casting technology must be used. In addition, some complex cavities and hollow structures with complex shapes that are difficult to machine must be completed using precision casting technology.

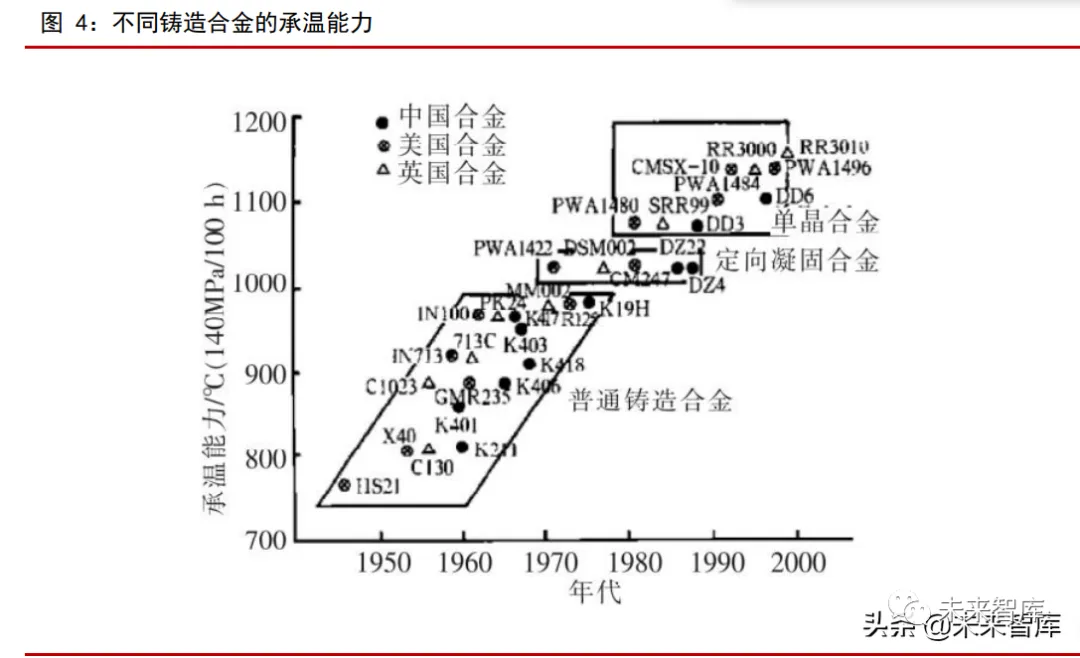

Casting high-temperature alloys can be divided into equiaxed crystal casting high-temperature alloys, directional solidification columnar crystal high-temperature alloys, and single crystal high-temperature alloys according to their solidification and crystallization structures. Their performance and preparation difficulty increase in order. From ordinary cast high-temperature alloys to single crystal high-temperature alloys, the temperature bearing capacity has been increased by 500 ℃. The development of nickel based single crystal high-temperature alloys using directional solidification technology has been particularly rapid, becoming the preferred material for aircraft engine blades.

The main grades of cast high-temperature alloys have a nickel content of over 60%, even exceeding 70%. The nickel content of DD402 is about 60%, K401 is about 68.9%, K403 is about 66.1%, and K418 is about 73.9%.

Isoaxial crystal casting high-temperature alloys can be used at -235~1050 ℃, with advantages such as low manufacturing cost and excellent mechanical properties at medium and low temperatures. They are widely used in the production of large and complex structural components such as aircraft engine diffusers and casings, integral cast turbines, guides, guide and turbine blades, and related components such as aerospace rocket engine turbopumps. K418 alloy has a relatively simple composition, low density, and good creep strength, thermal fatigue performance, and oxidation resistance below 900 ℃. It is the main material for high-temperature components such as aircraft engines and industrial gas turbine turbine blades.

K438 is one of the most heat-resistant and corrosion-resistant casting high-temperature alloys, with composition and properties comparable to IN738 widely used abroad. In addition to excellent heat and corrosion resistance, it also has moderate high temperature strength and good organizational stability. It is widely used as turbine working blades and guide blades for long-life ships and ground industrial gas turbines operating below 900 ℃, and can also be used as turbine components for aviation engines.

Directional solidification alloys make the crystallization direction of the alloy parallel to the principal stress axis of the part, effectively eliminating transverse grain boundaries perpendicular to the stress axis. It not only has good creep fracture strength and plasticity at medium and high temperatures, but also has thermal fatigue performance about 5 times higher than the original alloy, and has been widely used in advanced aircraft engines and ground gas turbines. China began researching directional solidification technology for high-temperature alloys in the mid-1960s, and has produced and replicated nearly ten grades of directional solidification alloys. DZ3 and DZ5 are developed using directional solidification technology on the basis of ordinary cast high-temperature alloys, and have greatly improved tensile shaping, durability strength, and thermal fatigue life.

DZ22, DZ125, DZ17G, etc. are imitation alloys, among which DZ125 is currently one of the highest performance oriented solidification high-temperature alloys, with good medium to high comprehensive performance and excellent thermal fatigue performance. Its performance level reaches or even exceeds that of PWA1422 alloy in the United States.

Single crystal high-temperature alloy is an alloy type developed on the basis of directional solidification alloy, which completely eliminates grain boundaries and improves the thermal strength performance of the alloy by 30 ℃. It is mainly used for manufacturing hot end turbine blades for aircraft engines and gas turbines. Since the successful development and application of PWA1480 single crystal high-temperature alloy in the 1980s, foreign countries have successively developed high-strength single crystal alloys of different generations. The temperature bearing capacity of the alloy has slowly increased at a rate of 20-30 ℃/generation, and the current temperature bearing capacity has reached 1100 ℃.

Domestic single crystal alloys have been independently developed to the third generation single crystal alloys DD33, DD9, and the fourth generation single crystal alloys DD91, DD15, etc. In the early 1980s, the Aerospace Materials Institute was the first to successfully develop the first generation of single crystal high-temperature alloy DD3, which was successfully applied to the turbine blades of aircraft engines. In the 1990s, the second generation of single crystal high-temperature alloy DD6 was developed, and its various properties reached or were close to the widely used second-generation single crystal alloy abroad. DD15 alloy was the fourth generation single crystal high-temperature alloy developed by the Aerospace Materials Institute, and its durability was better than the fourth generation single crystal high-temperature alloy EPM-102 in the United States.

1.3 Powder high-temperature alloy

Powder high-temperature alloys are a new generation of high-temperature alloys that emerged in the 1960s. They are made from metal powders as raw materials and undergo subsequent heat treatment to obtain alloys with high tensile strength and good fatigue resistance. Powder metallurgy high-temperature alloys can meet the requirements of engines with high stress levels and are the preferred material for high-temperature components such as turbine disks, compressor disks, and turbine baffles in high thrust to weight ratio engines. With the rapid development of the aviation industry, there is an increasing demand for the performance and quantity of powder high-temperature alloys. Currently, the international research and development of powder high-temperature alloys has entered the fourth generation.

The research on powder high-temperature alloys in China started relatively late, starting in the late 1970s. The earliest domestic company to develop powder high-temperature alloy products was Gangyan Gaona. In addition, there are several units such as Beijing University of Science and Technology and Aerospace Materials Institute. Currently, the main models include FGH95, FGH96, FGH97, FGH98, etc. (Report source: Future Think Tank)

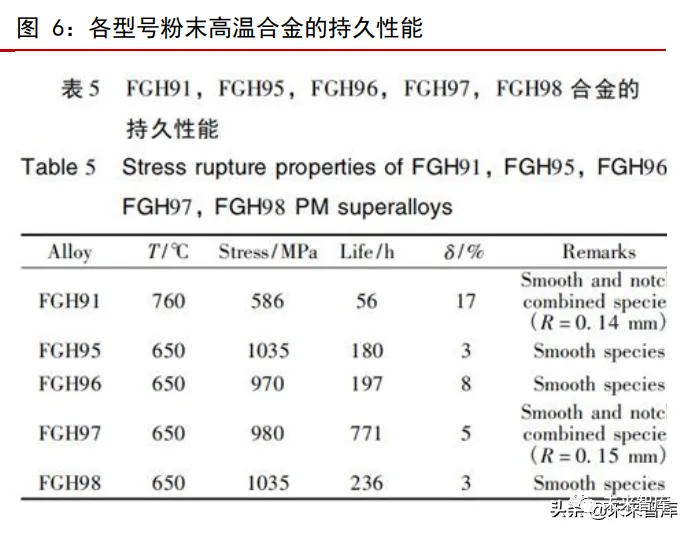

FGH95 is the first powder metallurgy high-temperature alloy developed in China in the early 1980s. It has the highest strength level under 650 ℃ usage conditions and can be used to manufacture high-temperature structural components such as high and low-pressure turbine discs, compressor discs, and turbine rings for high thrust ratio new engines. FGH96 has a 10% decrease in strength compared to FGH95, but its ability to resist crack propagation has doubled compared to FGH95. It is used at a temperature of 750 ℃ and is a key material for preparing advanced engine turbine disks and other hot end components. FGH97 alloy has the advantages of high durability, high creep resistance, and low crack propagation rate. 700 ℃ is a typical working temperature range and is a key material for preparing advanced engine turbine disks, shafts, rings, and other hot end components.

The main grades of powder high-temperature alloys have a nickel content between 50% and 60%, with FGH95 having a nickel content of 62%, FGH96 and FGH97 having a nickel content of 55.7%, and FGH98 having a nickel content of 52.4%.

2. Market demand for high-temperature alloys

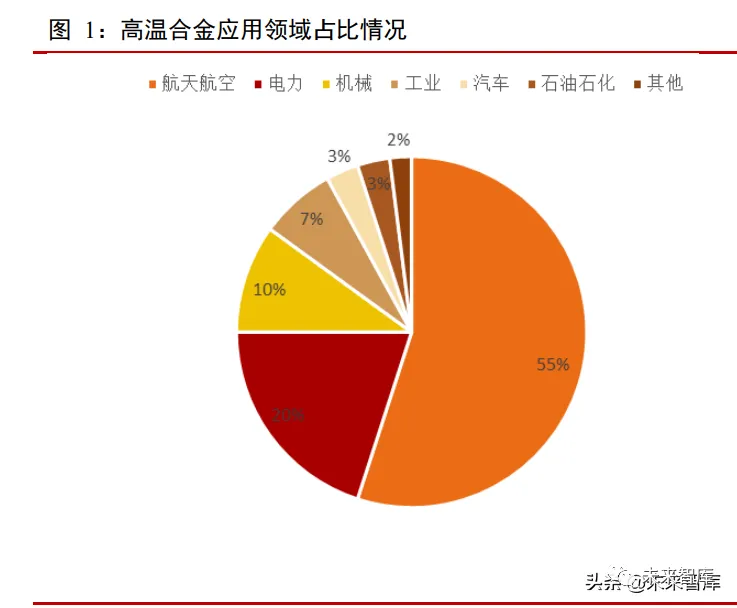

High temperature alloy materials were initially mainly used in the aerospace industry and were the preferred materials for aircraft engines. With the development of technology and the increase in production, the high-temperature and corrosion-resistant characteristics of high-temperature alloys have gradually made them widely used in civil industries such as diesel engines and internal combustion engine turbocharging, gas turbines, energy and power, petrochemicals, and glass building materials.

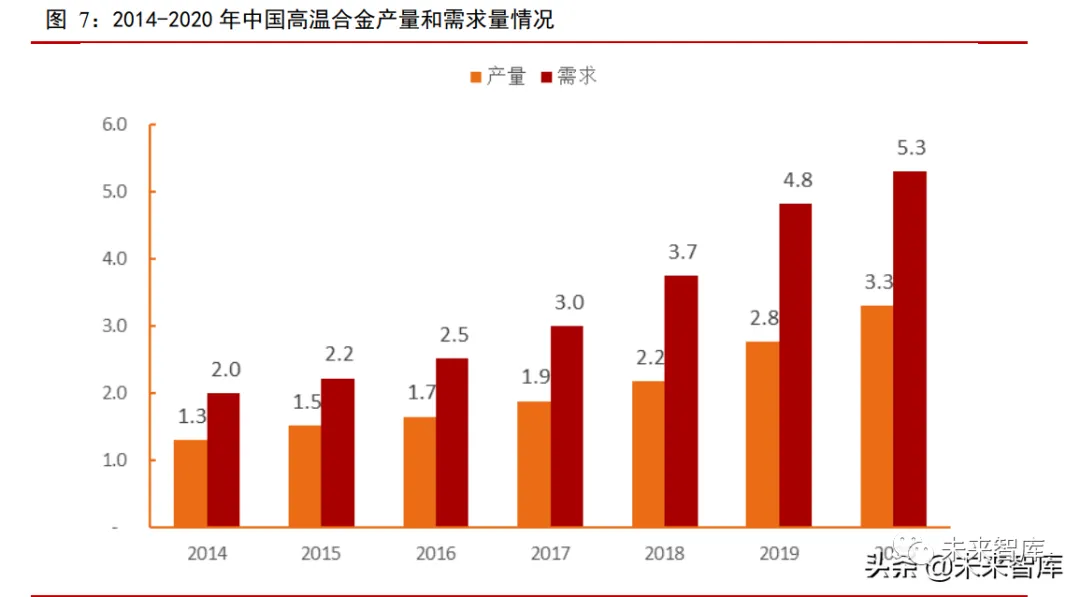

According to statistics from the China Special Steel Enterprise Association, the demand for high-temperature alloys in China showed a rapid growth trend from 2014 to 2020, with a compound annual growth rate of around 17% between production and demand. In 2020, the domestic production of high-temperature alloys was 33000 tons, with a demand of approximately 53000 tons, resulting in a supply-demand gap of 20000 tons.

Military and civil aviation engines are the main sources of demand, and demand in other fields is also strong. According to the prospectus of Tunan Corporation, it is estimated that the average annual demand for high-temperature alloys in China during the 14th Five Year Plan period will reach 83500 tons, based on the comprehensive forecast of the demand for military aircraft installation and updates, as well as other application fields.

2.1 High temperature alloys are the cornerstone of advanced engines

2.1.1 Different requirements for the four major hot end components

Aircraft engines are known as the "flower of industry" and are one of the most technologically advanced and challenging components in the aviation industry. High temperature alloy materials are key materials for manufacturing hot end components of aircraft engines, and the performance level of engines largely depends on the performance level of high-temperature alloy materials. Therefore, they are known as the "cornerstone of advanced engines".

High temperature alloys account for 40% to 60% of the total weight of modern aviation engines, mainly used for the four hot end components: combustion chamber, guide vanes, turbine blades, and turbine discs. In addition, they are also used for components such as the casing, rings, afterburner, and exhaust nozzle.

The high-temperature alloy used in the combustion chamber is mainly deformed high-temperature alloy. The combustion chamber is the source of power mechanical energy, and the temperature of the generated gas is between 1500 and 2000 ° C. Therefore, materials need to be resistant to high temperatures, as well as have oxidation resistance, thermal corrosion resistance, and good cold and hot fatigue performance. The high-temperature alloys used for combustion chambers abroad include Haynes188 cobalt based high-temperature alloy (third-generation fighter F100), HastelloyX nickel based high-temperature alloy (third-generation fighter F110, F404, and F414), new combustion chamber structures (fourth generation fighter F119 and F135 adopt floating wall structure, F136 engine adopts Lamilloy structure), and high-temperature alloys coated with thermal barrier coatings (fifth generation fighter). The main ones in China are GH4169 and GH141.

The main material of the guide is cast high-temperature alloy. The guide vane is one of the components with the greatest thermal impact on the turbine engine, and its material working temperature can reach up to 1100 ° C or above. However, as it is a stationary blade, it does not bear much mechanical load. Usually, distortions caused by stress, cracks caused by drastic temperature changes, and burns caused by overburning can lead to frequent malfunctions of guide vanes during operation. According to its working conditions, the material is required to have sufficient durability and good thermal fatigue performance. The main material of the guide is cast high-temperature alloy, commonly used models such as IN718C, PWA1472, Rene220, R55, etc. The K417G developed by the Institute of Metal Research, Chinese Academy of Sciences has been successfully used to produce low-pressure first and second stage turbine guide vanes for Taihang engines.

Powder high-temperature alloys are essential materials for modern high-performance engine turbine discs. The turbine disk has the highest mass among the four major hot end components. Uneven heating during work, with the rim temperature reaching 550-750 ° C and the center temperature only around 300 ° C. The tenon teeth bear the maximum centrifugal force, and the stress they experience is more complex. Therefore, it is required that the turbine disk material has high yield strength and creep strength, good mechanical fatigue resistance, and a small coefficient of linear expansion. The materials used for turbine disk manufacturing are mainly powder metallurgy high-temperature alloys, such as IN100 powder high-temperature alloy (F100 engine) and commonly used FGH95, GFH96, FGH97, FGH98, and FGH91 alloys in China.

Single crystal high-temperature alloys are preferred for turbine blades. Turbine blades are the most critical components in aircraft engines that operate under the harshest conditions. The continuous improvement of its structure and materials has become one of the key factors in enhancing the performance of aircraft engines. The third-generation single crystal high-temperature alloy CMSX-10 and the fourth generation single crystal high-temperature alloy EPM-102 are commonly used. In recent years, Japan has successfully developed fourth, fifth, and sixth generation single crystal alloys TMS-138, TMS-162, TMS-238, etc. with higher temperature bearing capacity. China's independently developed third-generation DD9 is mainly used in the manufacturing of blades for improved Taihang engines.

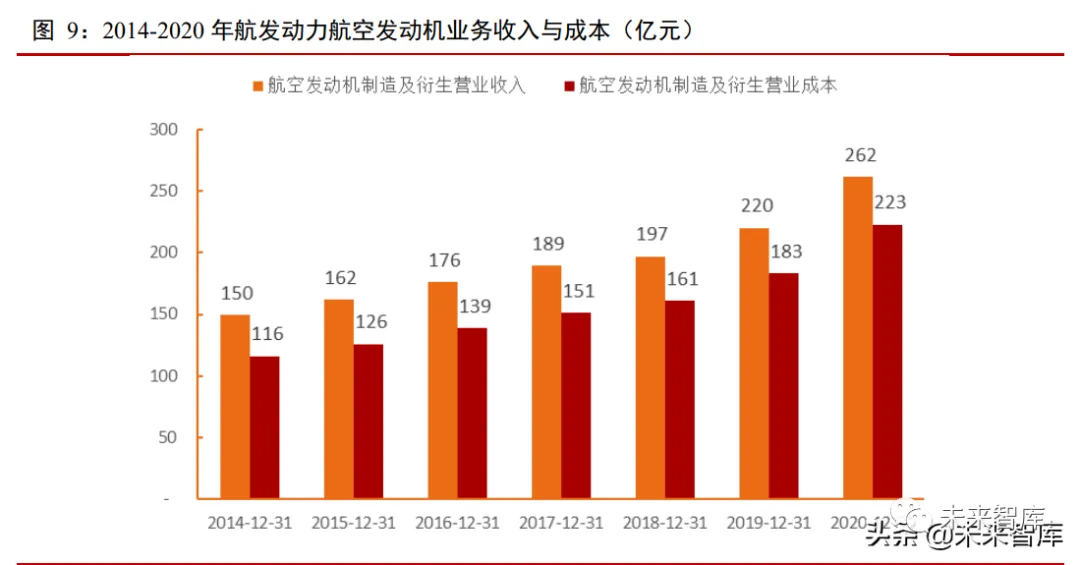

2.1.2 Growth in demand for military and civilian aircraft

The demand for high-temperature alloys in the field of aviation engines is divided into military and civilian markets. With the increasing efforts of the country in independent research and development of aviation engines, as well as the implementation of policies such as the "two aircraft" major project and the "separation of flight and engine", the development of the industry is accelerating day by day. As the only final assembly unit of aviation engines in China, Aero Engine Power's manufacturing business revenue increased from 15 billion yuan in 2014 to 26.2 billion yuan in 2020, with a compound annual growth rate of 9.7% and a growth rate of 18.8% in 2020. Based on the operating cost of 22.3 billion yuan for aircraft engine manufacturing by Aero Engine Power in 2020, raw material costs account for about 50% of the total operating cost, with high-temperature alloys accounting for about 40% of the raw material cost. It is estimated that the demand for high-temperature alloys generated by Aero Engine Power is about 4.46 billion yuan.

The sustained increase in military spending has driven an increase in orders and technological updates. According to the government budget draft report submitted by the Chinese Ministry of Finance at the National People's Congress, China's defense expenditure budget for this year has increased by 7.1% compared to 2021, an increase of 0.3 percentage points from last year. From 2016 to 2021, the increase in China's defense budget was 7.6%, 7%, 8.1%, 7.5%, 6.6%, and 6.8%, respectively. According to the Ministry of National Defense, China's military spending is mainly used for four aspects: steadily promoting the modernization of weapons and equipment construction, major projects and key projects specified in the 13th Five Year Plan, phasing out and updating some outdated equipment, and upgrading and renovating some old equipment. With the acceleration of military aircraft procurement and the increase in aircraft engine orders, there is strong demand for domestically produced high-temperature alloys.

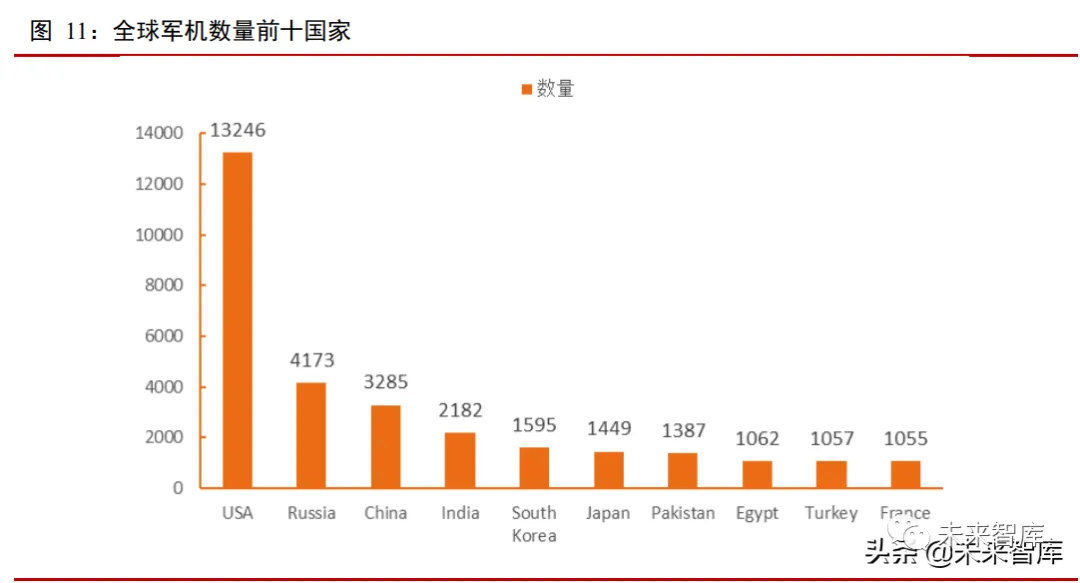

There is a significant gap in the number and generation of military aircraft between China and developed countries, and there is an urgent need to update advanced equipment. According to data released by Flight Global, the total number of active military aircraft in the United States is 13246, with 4173 from Russia and 3285 from China. The number of US military aircraft is approximately four times that of China. Structurally speaking, China has a high proportion of outdated fighter jets, and there is a huge demand for military aircraft to make up for deficiencies and upgrade and replace them. In 2018, China had 3187 military aircraft, an increase of 589 compared to 2011, with a compound annual growth rate of 2.96%. If this compound annual growth rate is maintained, it is expected that China will add 1751 new military aircraft in the next 15 years. Based on the basic assumption that the ratio of single engine to double engine quantities for existing and new military aircraft is 1:1, and taking into account factors such as maintenance and backup, China is expected to add 10506 new military aviation engines in the next 15 years, with an estimated annual demand for high-temperature alloy raw materials of approximately 26264 tons.

In the next 10-20 years, the demand for civil aviation will also greatly drive the demand for high-temperature alloys. According to the China market outlook report released by Boeing, the size of China's civil aviation fleet is expected to expand to 7210 aircraft by 2034. As of the end of 2017, the total number of registered aircraft of general aviation enterprises reached 2297. In the future, China will increase its civil aircraft fleet by 4913. Currently, mainstream civil aircraft are equipped with 2-4 engines. Assuming an average of 3 engines per civil aircraft, 14739 new engines will be added in the future, resulting in an average annual demand for approximately 36848 tons of high-temperature alloys.

According to the prospectus of Western Superconductor, it is predicted that the demand for high-temperature alloys for military aviation engine traction in China will be 603 million US dollars in the next decade, and the demand for high-temperature alloys in the civil (including aviation) aviation engine field in China will exceed 3.669 billion US dollars in the next 20 years.

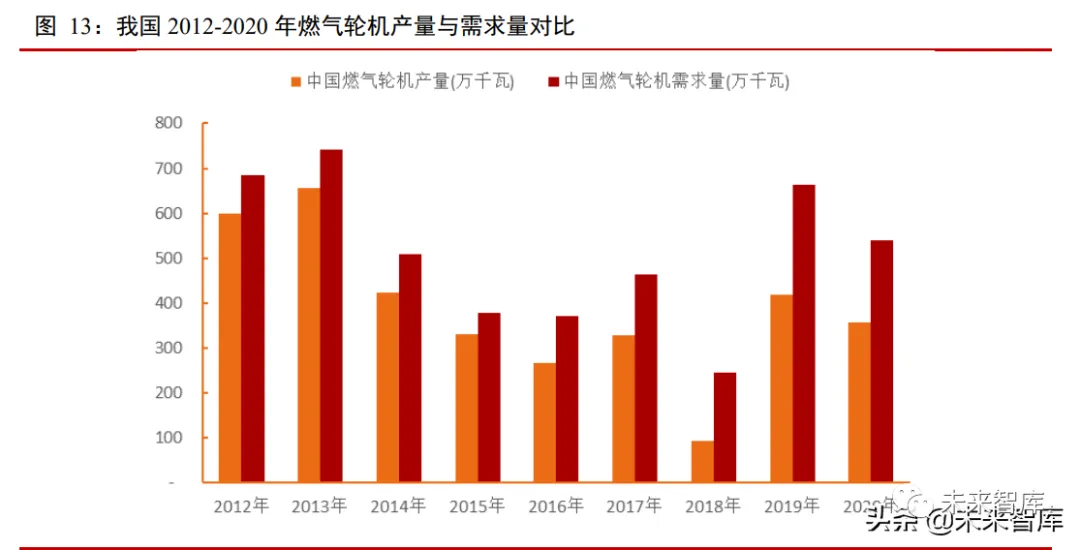

2.2 Gas turbines have a strategic position in the energy sector

A gas turbine device is a rotary heat engine that uses air and gas as the medium. Its structure and principle are similar to aviation engines, and the mass proportion of high-temperature alloys in gas turbines is also 40% to 60%.

Gas turbine is a strategic industry involving national energy. It is not only an extremely critical equipment in national defense equipment, but also has an irreplaceable strategic position in fields such as electricity, energy extraction and transmission, and distributed energy systems. Based on the important position of gas turbines, developed countries attach great importance to the development of gas turbines. Currently, the industry is mainly monopolized by a few companies such as GE from the United States, Mitsubishi Heavy Industries from Japan, and Siemens from Germany.

The overall level of gas turbines in China currently lags behind the international advanced level by 20-30 years. The development of gas turbines is crucial for the research of advanced manufacturing and energy technologies in China, among which the study of high-temperature alloy technologies such as single crystal alloys, super cooled blades, thermal barrier coatings (TBC), anti-oxidation and hot corrosion coatings is an important part of the development of gas turbines.

The large-scale application of gas turbines brings broad market prospects to the high-temperature alloy industry. Gas turbines are one of the key development directions of China's "two major projects". Among the four major projects in the new century, "West East Gas Transmission", "West East Power Transmission", and "South to North Water Diversion" all require a large number of 30 megawatt industrial gas turbines. At the same time, the rapid development of China's shipbuilding industry requires a large number of 30 megawatt ship gas turbines.

2.3 High temperature alloys are also needed in the high-end civilian field

With the continuous improvement of the performance of high-temperature alloys, their application scope is gradually expanding, especially the application of high-temperature and corrosion-resistant alloys in industries such as power, machinery manufacturing, and petrochemicals has made significant progress. In addition, it has also extended to fields such as glass manufacturing and medical equipment. The market demand for civilian high-temperature alloys is also strong, and the market development prospects are broad.

In the field of electric power, the development of coal power and nuclear power both need high-temperature structural materials as support. In terms of coal-fired power, ultra-high pressure steam parameter units, superheaters, and reheaters have high requirements for materials' high temperature resistance, pressure resistance, and creep resistance, and high-temperature alloys are their key materials. At present, the main pipe material for the superheater of thermal power boilers in China is iron-based high-temperature alloy GH2948.

In terms of mechanical manufacturing, the main focus is on automobile manufacturing and diesel engines. High temperature mechanical properties are required for components such as automobile turbochargers, engine exhaust pipes, internal combustion engine valve seats, inserts, intake valves, sealing springs, spark plugs, bolts, and heat generators. These parts are important application areas for high-temperature alloys, among which automobile turbochargers are the most important application area for high-temperature alloys in automobiles. Currently, domestically developed casting high-temperature alloys such as K213, K418, K419, and K4002 are widely used for turbocharger materials.

Petrochemical industry equipment requires a large amount of iron-based and nickel based alloy materials due to harsh operating conditions, especially for pressure vessels, pipelines, fittings, valves, etc. The main grades used are IN718, GH2747, etc.

3. Supply in the high-temperature alloy market

The research and development of high-temperature alloys in China started relatively late, and there is still a significant gap in overall technological development compared to strong countries such as the United States and Russia. In addition, the domestic production capacity is insufficient, and high-end varieties have not yet achieved independent controllability, resulting in a large supply-demand gap. The future development and import substitution prospects are broad.

In 2020, the demand for high-temperature alloys in China was about 53000 tons, while the production capacity was only 33000 tons, indicating a significant supply-demand problem. According to data from Zhiyan Consulting, currently about 40% of high-temperature alloys for military aviation engines in China rely on imports, and the entire industry's dependence on imports is nearly 50%. Both the government and high-temperature alloy companies are eager to get rid of the "bottleneck" problem.

The wide application fields of high-temperature alloys make them of great strategic significance. The country attaches great importance to the development of the high-temperature alloy industry. For a long time, a large number of policies have been involved in the strategic planning of high-temperature alloys, especially during the 13th Five Year Plan period, the "Two Special Projects" (aviation engines and gas turbines) were fully launched, requiring the promotion of the development of large aircraft engines, advanced helicopter engines, heavy-duty gas turbines and other products. The basic research, technology and product development, and industrial system for independent innovation of aviation engines and gas turbines were initially established, further laying the special position of high-temperature alloys in cutting-edge materials.

The "13th Five Year Plan for Scientific and Technological Innovation in the Materials Field" proposes to strengthen the construction of China's material system, vigorously develop high-performance carbon fiber and composite materials, high-temperature alloys, military new materials, third-generation semiconductor materials, new display technologies, special alloys, and rare earth new materials, etc., to meet the material needs of major projects and national defense construction in China. Preliminary establishment of China's independent basic and new material system, with a self-sufficiency rate of over 80% for key materials.

New entry barriers are high, the industry landscape is relatively stable, and the growth rate of production capacity is relatively slow. The high-temperature alloy industry is affected by national strategies, high technological barriers, long certification cycles, and high funding requirements. Although some manufacturers have entered in recent years, they still need to pass various certifications and quality inspections, which may affect the current situation. Currently, production growth mainly relies on the expansion of existing manufacturers.

3.1 Localization process of high-temperature alloys

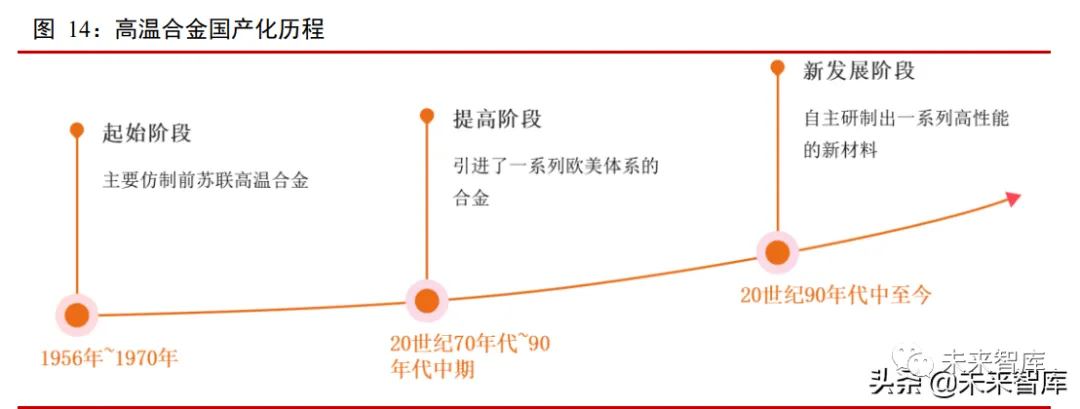

China produced its first high-temperature alloy in 1956. Over the past 60 years, China's high-temperature alloys have grown from scratch, from imitation to innovation, from low to high, forming a complete high-temperature alloy system with Chinese characteristics. This ensures that the high-temperature alloy materials required for China's aerospace engines and gas turbines are fully based domestically, and also provides the necessary high-temperature materials for the development of other industrial sectors.

According to "Development and Innovation of High Temperature Alloys in China", the development of high-temperature alloys in China can be divided into three stages, from imitating the Soviet Union, Europe, and America to independent innovation:

The first stage, from 1956 to 1970, was the entrepreneurial and initial stage of high-temperature alloys in China. The international situation at that time required China to independently develop and produce high-temperature alloy materials required for major fighter jet engines such as WP-5, WP-6, WP-7, and WP8. The main achievement of this stage is to imitate the superalloy series dominated by the former Soviet Union, such as GH4033, GH4037, GH4049, GH2036, GH3030, K403, K406, etc. At the same time, a batch of iron nickel base superalloys, such as GH4033 (GH2135), GH4037 (GH2130, GH2302), etc., have also been developed, especially in view of the lack of nickel and chromium resources in China.

The second stage, from the 1970s to the mid-1990s, was a period of improvement for high-temperature alloys in China. With the trial production and production of some aircraft engines imitating European and American models, a series of alloys from European and American systems have been introduced, especially in the development of high-temperature alloy materials required for engines such as WS9, WZ-6, and WZ-8, which fully introduce European and American technologies. At this stage, not only have a series of new alloys been successfully developed, including high-performance deformation alloys, casting alloys, directional solidification, and single crystal alloys, but more importantly, the production process technology and product quality control of high-temperature alloys in China have reached a new level, basically reaching or approaching the level of Western industrialized countries.

The third stage, from the mid-1990s to the present, is a new development stage of high-temperature alloys in China. In this stage, with the design, development, and production of new advanced aircraft engines such as WP-14, WS-9, and WS-10, a series of high-performance new materials are required and successfully developed, such as powder turbine disk materials FGH4095 and FGH4096, first and second generation single crystal high-temperature alloys DD402, DD408, DD406, etc. At the same time, the production of GH4169 discs, the main production variety in China, has further developed.

At present, China has formed a relatively complete high-temperature alloy system, and some products have achieved import substitution. However, due to the late start of research, the overall technological level still lags behind the international advanced level. In recent years, various enterprises and research units have actively conducted engineering research on high-performance high-temperature alloys, gradually breaking through technological bottlenecks and achieving considerable results, such as Tunan Group's high-temperature alloy vacuum casting technology, high-temperature alloy vacuum smelting composite de S process technology, etc. The performance and organization of products based on these technologies have reached the advanced level in China, and have the foundation to replace imported products.

Due to the US ban on the export of advanced high-temperature alloy materials, domestically produced high-temperature alloy products for aircraft engines are all self-produced. Since the beginning of the 21st century, in order to meet the performance requirements of advanced domestic aviation engines, China has independently developed various new high-temperature alloys, including the third-generation single crystal high-temperature alloy DD9, the new generation 600 ℃ high-temperature titanium alloy TA29, and high-quality GH4738 alloy.

3.2 Two special projects to accelerate industry development

The "Two Machine Special Project" accelerates the development of aviation engines and gas turbines, benefiting upstream high-temperature alloys. On November 24, 2016, the National Industrial and Information Technology Innovation Conference fully launched the implementation of the major special project for aviation engines and gas turbines (the "Two Engine Special Project"). The country will invest billions of yuan to break through the key technologies of the "Two Engines". As an important material that accounts for over 50% of the two machines, high-temperature alloys will also face huge demand growth and import substitution space. Since the launch of the "Two Aircraft Special Project", a large number of encouraging policies focusing on aviation engines and high-temperature alloys have been introduced, which is conducive to further technological development and accelerating the pace of capacity expansion.

3.2.1 Requirements for Two Machines

The "Two Engine Special Project" is a major national science and technology project. The purpose of establishing the "Two Engine Special Project" is to establish an independent innovation capability system for China's two engine power industry through independent research and development of key models, and to build China's aviation engine and gas turbine industry into a strategic high-tech industry with international competitiveness, in order to meet the demand for high-performance power equipment in China's aviation, energy, and power industries.

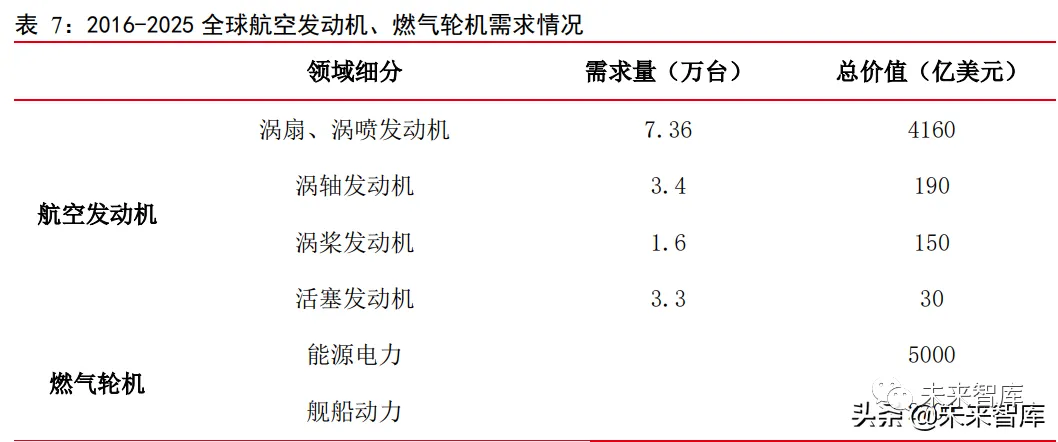

In terms of aircraft engine specialization, the focus will be on the fields of turbofan and turbojet engines, while also taking into account the market demand for turboshaft, turboprop, and piston engines; The main goal of the gas turbine project is to achieve independent development of F-class 300MW gas turbines by 2020 and H-class 400MW gas turbines by 2030.

From 2016 to 2025, the global market has a strong demand for aviation engines, with a total demand value of up to 453 billion US dollars. Gas turbines are widely used in many fields such as electricity, ships, and manufacturing, and also have broad prospects, with a future demand of up to 770 billion US dollars.

3.2.2 Two machine special beneficiary enterprises

The launch of the "Two Engine Special Project" will fundamentally solve the problem of insufficient investment that has long plagued China's aviation engine and gas turbine industries. It will provide abundant research funds for topics and projects in addition to model and equipment development funds, inject strong impetus into the development of China's two engine industry, and bring huge market opportunities to the aviation engine and gas turbine industry chain. The market prospects of the high-temperature alloy industry, as an important raw material, are even greater.

Aircraft engines are the heart of airplanes, and their industrial chain mainly consists of raw materials, components, blades, and power control systems. Especially in the context of the significant gap between China's high-end alloy materials and advanced countries such as Europe and America, raw materials will be an important investment direction for the "Two Aircraft Special Project". The main research and development forces for gas turbines come from China's aerospace, shipbuilding, machinery and other industrial departments and research institutes, and related research and development enterprises will also benefit from them.

3.3 Current Supply Pattern in the Domestic Market

Domestic enterprises mainly compete with each other, with the goal of achieving technological innovation, expanding production capacity, and meeting market demand for common development. Domestic enterprises have different business forms, and there is a certain gap in overall technological level compared to the international advanced level, so there is less direct competition. At present, the participation of high-temperature alloys in production in China can be divided into three categories:

The first type is represented by special steel plants such as Fushun Special Steel, Baosteel Special Steel, and Great Wall Special Steel. We have complete production equipment and rich experience, and have laid out various metal material production lines, with deformation high-temperature alloys being the main focus.

The second type is represented by research institutions such as Steel Research Institute, Aerospace Materials Institute, and Institute of Metals, Chinese Academy of Sciences. Research institutions have participated in the construction of China's high-temperature alloy system earlier, mainly responsible for the research and production of advanced high-temperature alloy materials and production processes, and mastering the industry's cutting-edge production technologies and processes.

The third category is emerging enterprises represented by Tunan Corporation and Western Superconductor. These types of enterprises entered the high-temperature alloy track before and after the introduction of the "two machine special" policy. Due to their late start and relatively weak technological accumulation, they are actively promoting the construction of "two machine special" projects to expand production capacity.

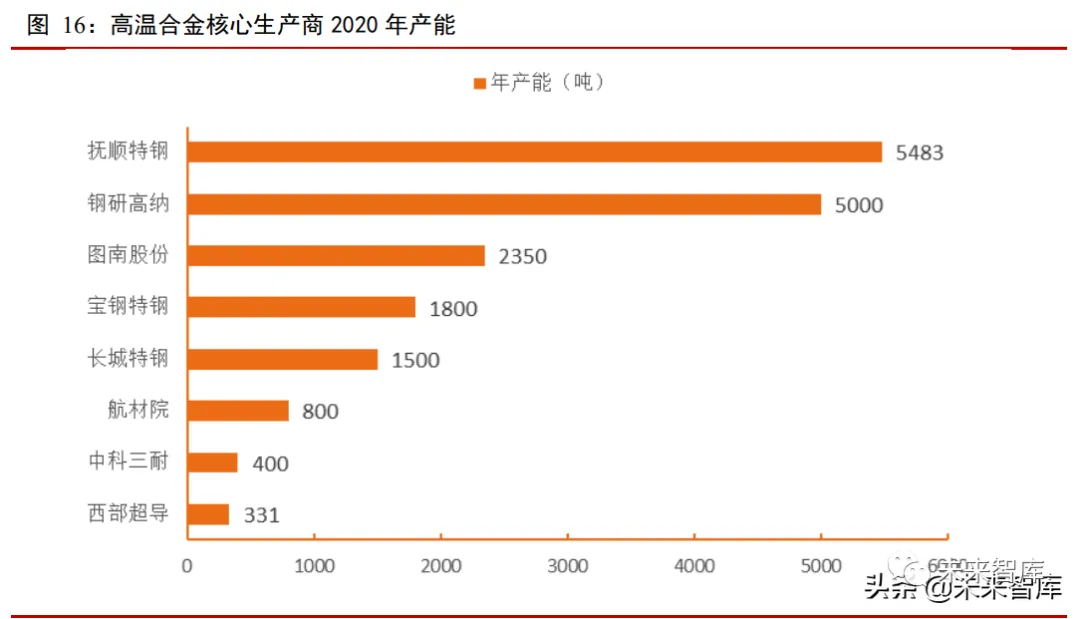

The supply-demand gap is further widening, and the industry is expected to continue its high prosperity. In 2020, the total production capacity of high-temperature alloys in China was 33000 tons, of which the total production capacity of core manufacturers was 17000 tons. The demand for high-temperature alloys was 53000 tons, and the supply-demand gap was 20000 tons. According to comprehensive calculations from the demand side, the annual demand for high-temperature alloys in China during the 14th Five Year Plan period will reach 83000 tons. Based on the estimated production capacity in 2020, the annual supply-demand gap in the future will be around 50000 tons.

Among the core manufacturers, the first tier is mainly represented by Fushun Special Steel, Steel Research High tech, and Tunan Co., Ltd. Among them, Fushun Special Steel currently has the highest production capacity and is also a leading producer of deformed high-temperature alloys in China; Gangyan Gaona has a high market share in the field of new high-temperature alloys; In recent years, the revenue proportion of high-temperature alloy precision castings produced by Tunan Co., Ltd. has been continuously expanding.

Faced with the increasing demand for high-temperature alloys, major domestic listed high-temperature alloy companies are actively laying out and implementing production capacity improvement plans, which are expected to bring a supply increase of 12000 tons per year.

Analysis of Four Major Listed Companies

4.1 Fushun Special Steel: The Cradle of China's Special Steel

Fushun Special Steel is the core production unit of special steel for military and civilian use in China. The company leads the development of special steel materials in China by researching and producing "high, precision, cutting-edge, unique, difficult, scarce, special, and new" products, and is known as the "cradle of China's special steel". At the same time, the company has also opened the prelude to the development of China's high-temperature alloy industry from scratch, from low-level to high-level, from imitation to independent innovation, and is currently the leading enterprise in high-temperature alloys in China.

The company was founded in 1937 and is one of the earliest special steel enterprises in China. It has created many firsts in the history of metallurgy in China, including the production of the first high-speed steel, the first austenitic stainless steel, the first ultra-high strength steel, the first high-temperature alloy, the first ultra-low carbon stainless steel, etc. It has also provided important raw materials for the development of China's first atomic bomb, the first hydrogen bomb, and the first artificial satellite. On the 50th anniversary of the National Day, more than 80% of the special steel and new materials used in the new weapons displayed in the Tiananmen Square parade were provided by Fushun Special Steel. In recent years, the group company has closely cooperated with several important military enterprises such as Aerospace Science and Technology Group in the research and production of special steel, forming a strong alliance between the defense industry and special steel enterprises. (Report source: Future Think Tank)

In order to meet the development opportunities of the industry and maintain its leading position, the company has planned and implemented multiple expansion and technological transformation projects in recent years, focusing on improving production efficiency and transforming product structure to better serve the demand for raw materials such as high-temperature alloys and ultra-high strength steel in China's aviation, aerospace, and energy power gas turbine fields.

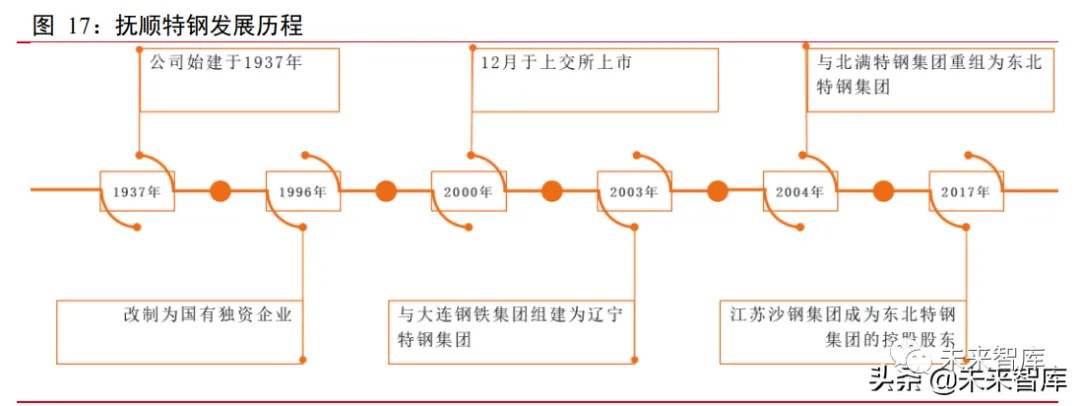

4.1.1 "Rebirth from the ashes" of old state-owned enterprises

Fushun Special Steel was listed on the Shanghai Stock Exchange in 2000. In January 2003, it merged with Dalian Iron and Steel Group to form Liaoning Special Steel Group. In September 2004, it restructured with Beiman Special Steel Group to form Northeast Special Steel Group. In 2017, Northeast Special Steel Group implemented mixed ownership reform, and Jiangsu Shagang Group became the controlling shareholder of Northeast Special Steel Group. In 2018, due to financial indicators involving delisting risk warnings, it was subject to delisting risk warnings. In 2019, Jiangsu Shagang Group was introduced, opening the curtain of reform for integrated and innovative development. The company has undergone unprecedented changes in its business philosophy, salary distribution, organizational structure, talent utilization, purchase and sales mode, technological transformation and construction, cost reduction and efficiency improvement, and other aspects. Its management level has been comprehensively improved, and it has quickly turned losses into profits in the short term. In April 2021, it successfully took off its hat.

4.1.2 High temperature alloys are an important growth point for the company's future performance

Fushun Special Steel has always adhered to the development concept of "special steel is more unique". Over the years, it has produced and developed four core products: high-temperature alloys, ultra-high strength steel, high-end tooling steel, and special stainless steel, known as "three highs and one specialty". It has certain advantages in the domestic special steel industry. In addition, there are over 5400 grades of special steel materials, including key products such as high-speed tool steel, automotive steel, high-end machinery steel, titanium alloys, and bearing steel. Our company's products are aimed at both military and civilian markets, and are widely used in fields such as national defense and military industry, aerospace, energy and power, petrochemicals, transportation, mechanical and electrical engineering, environmental protection and energy conservation.

The company's high-temperature alloy products mainly consist of deformed high-temperature alloys, covering more than 800 specifications such as forgings, forgings, rolled materials, cold and hot rolled plates, and cold drawn materials. They are mainly used in China's aerospace and nuclear power fields, specifically for blades, turbine disks, casings, combustion chambers of various types of aviation engines, as well as hot end components of various types of rocket and missile power devices and engines. At present, Fushun Special Steel's high-temperature alloys have a market share of over 80% in the aerospace industry.

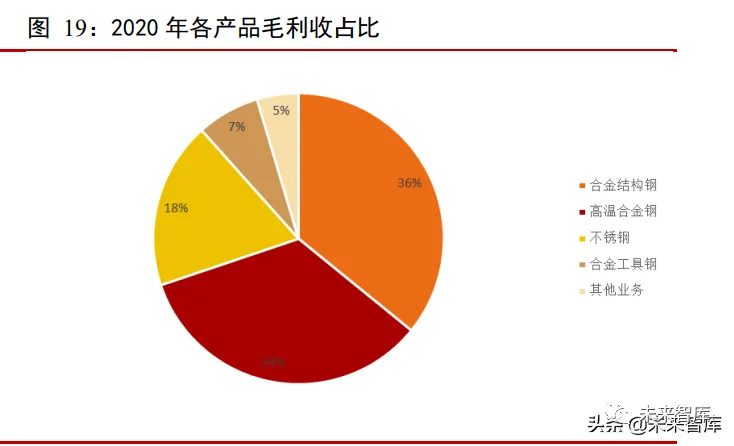

As the main source of profit for Fushun Special Steel, high-temperature alloys are an important growth point for the company's future performance. In 2020, the revenue from high-temperature alloys accounted for 19% of the company's main revenue, only lower than that of alloy structural steel. However, the gross profit margin of high-temperature alloys was 33.97%, with a gross profit margin of 40.38%, making it the company's highest gross profit margin product.

In the future, with the rapid development of high-end manufacturing industries such as equipment manufacturing, new energy, aviation, aerospace, and military in China, the demand for high-temperature alloys in the upstream will continue to increase. As a leading enterprise, Fushun Special Steel will also face greater opportunities, and in the process of technological project transformation, material upgrades, capacity increases, and import substitution are also within reach.

4.1.3 Steady growth in performance, significant achievements in cost reduction and efficiency improvement

After Shagang took over the company in 2017, its business continued to improve and both revenue and profit were restored. In 2018, the company achieved a revenue of 5.85 billion yuan, an increase of 17.3% year-on-year, and maintained a stable and upward trend thereafter. In 2020, it still had a growth rate of 9.3% under the impact of the epidemic. In Q3 2021, the revenue was 5.57 billion yuan, a significant increase of 18.1% year-on-year.

In 2018, the net profit attributable to the parent company also significantly increased, mainly due to the impact of restructuring income. The company's debt exempted from restructuring and net income of 2.826 billion yuan were included in the relevant financial data for 2018. After 2019, it returned to normal and grew rapidly. According to the company's announcement, the net profit attributable to the parent company in 2021 is expected to be 728-825 million yuan, an increase of 31.98% to 47.74% year-on-year.

We are making every effort to promote production organization adjustment and process optimization, achieving significant results in cost reduction and efficiency improvement, and continuously improving profitability. The company's gross profit margin for sales in 2019 was 16.6%, an increase of 2.1% compared to 2018. This was mainly due to the company's focus on improving profitability through technology and market development, prioritizing the development and sales of high gross profit products. In 2020, the gross profit margin increased by nearly 6% to 22%. The sales net profit margin increased from 5.3% in 2019 to 12.3% in Q3 2021.

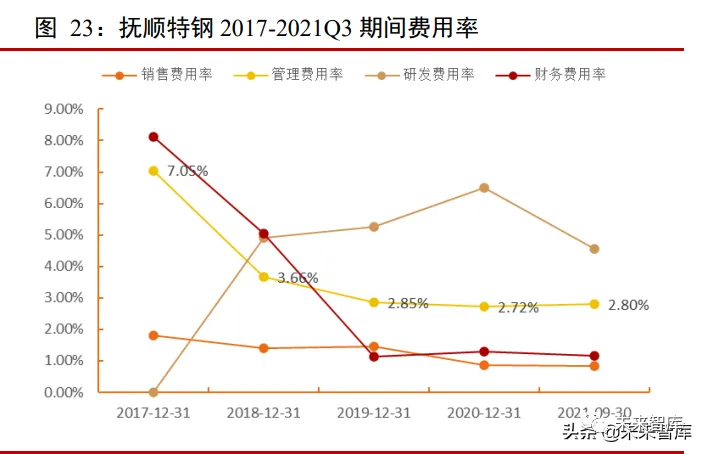

The new management team carries out business operations supported by technology research and development and cost control, with expenses decreasing year by year and R&D expenditures showing an increasing trend. In 2019, the company introduced advanced and efficient management mechanisms from Shagang Group, leading to a comprehensive improvement in its operational and management level. On the one hand, management expenses and sales expenses have been controlled, and financial expenses benefited from debt adjustment in 2019, with a significant decrease of 230 million yuan; On the other hand, since 2018, we have increased our research and development investment, focusing on the research and innovation of high-end alloys and special steel new materials for industries such as aviation, aerospace, nuclear energy, molds, machinery, and automobiles. In 2018, R&D expenditure was 288 million yuan, a year-on-year increase of 57.40%. In 2020, it was 407 million yuan, with a R&D expense ratio of as high as 6.5%. In recent years, emerging fields such as new energy vehicles, wind power, and photovoltaics have also been the focus of the company's development.

Fushun Special Steel, as an old steel enterprise, has formed almost irreplaceable high-tech barriers, strong economies of scale, and close customer stickiness after more than 80 years of arduous exploration. The company's active technological transformation and product transformation are also effective means to strengthen its leading position in the special steel industry. During the 14th Five Year Plan period, it is also the dividend period for China's large-scale military equipment deployment and replacement, and the demand for high-temperature alloys and other materials is more urgent. As an important supplier, Fushun Special Steel will have greater growth space and stronger bargaining power.

4.2 Western Superconductor: Leading the way in superconducting materials, followed by high-temperature alloys

Western Superconductor is a leading enterprise in the research and production of high-end titanium and superconducting materials in China, as well as an emerging supplier of high-performance high-temperature alloys. As the main R&D and production base for titanium alloy rods for aviation in China, the company has created two "unique" enterprises: the only commercial production enterprise for low-temperature superconducting wires in China, the only full process production enterprise for niobium titanium ingots, superconducting wires, and superconducting magnets in the world, and also one of the key R&D and production enterprises for high-performance high-temperature alloy materials in China.

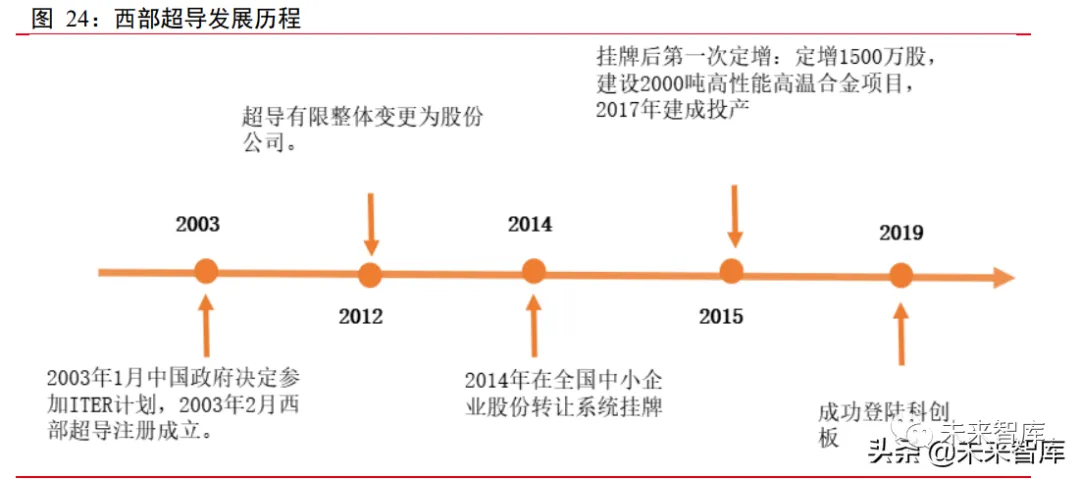

The establishment and development of the company have always been driven by national and industry demand. In 2003, it was established by the Northwest Nonferrous Metals Research Institute due to the industrialization demand for low-temperature superconducting wires used in the International Thermonuclear Experimental Reactor (ITER). In 2005, with the increasing requirements for titanium alloys for aviation in China's new fighter jets, the company carried out research on high-performance structural titanium alloys for new fighter jets and made breakthroughs. In 2014, in order to achieve the localization of high-temperature alloy materials in high-end fields such as aviation engines and gas turbines, the company conducted engineering research on high-performance high-temperature alloys and put them into production in 2018. After years of development, the company has gradually formed a product pattern where high-end titanium alloy materials, superconducting products, and high-performance high-temperature alloy materials coexist.

4.2.1 Titanium alloys dominate the market, and high-temperature alloys grow rapidly

The company's products are positioned as "internationally advanced, domestically blank, and urgently needed", filling the domestic gap, achieving import substitution, solving the "bottleneck" problem in aircraft manufacturing, and filling the "shortcomings" of key materials required for China's new fighter jets and shipbuilding. They are widely used in major national military equipment, large-scale scientific engineering, etc.

The company mainly engages in three major businesses: high-end titanium alloy materials, superconducting products, and high-performance high-temperature alloy materials. The first type of high-end titanium alloy material is mainly used in military aviation, ships, weapons and other fields, with major customers including large groups such as AVIC and AVIC; The second category is superconducting products, mainly used in medical magnetic resonance imaging, national defense and military industry, magnetic levitation and other fields. The company is the only supplier of low-temperature superconducting wires for ITER in China and has no competitors in the domestic market; The third category is high-performance high-temperature alloy materials, supplied for military aviation engines, gas turbine components, and nuclear power equipment.

Titanium alloy and high-temperature alloy are the two main materials used in the manufacturing of military aviation engines. The company has provided a large amount of high-quality titanium alloy materials to China's aviation industry, accumulated a good reputation in the industry, and established long-term cooperative relationships with customers such as AVIC and AVIC, laying a solid foundation for the market sales of high-performance high-temperature alloy materials after mass production.

Emerging supplier of high-temperature alloys, rapidly growing in volume. The company is one of the emerging suppliers of high-performance high-temperature alloy materials in China. Its products mainly include deformed high-temperature alloys, cast and powder high-temperature alloy parent alloys, etc. Deformed high-temperature alloys, represented by GH4169, GH738, GH907, GH4698, GH4720Li, etc., are mainly used in hot end parts such as turbine discs, casings, blades, etc. of aircraft engines and gas turbines.

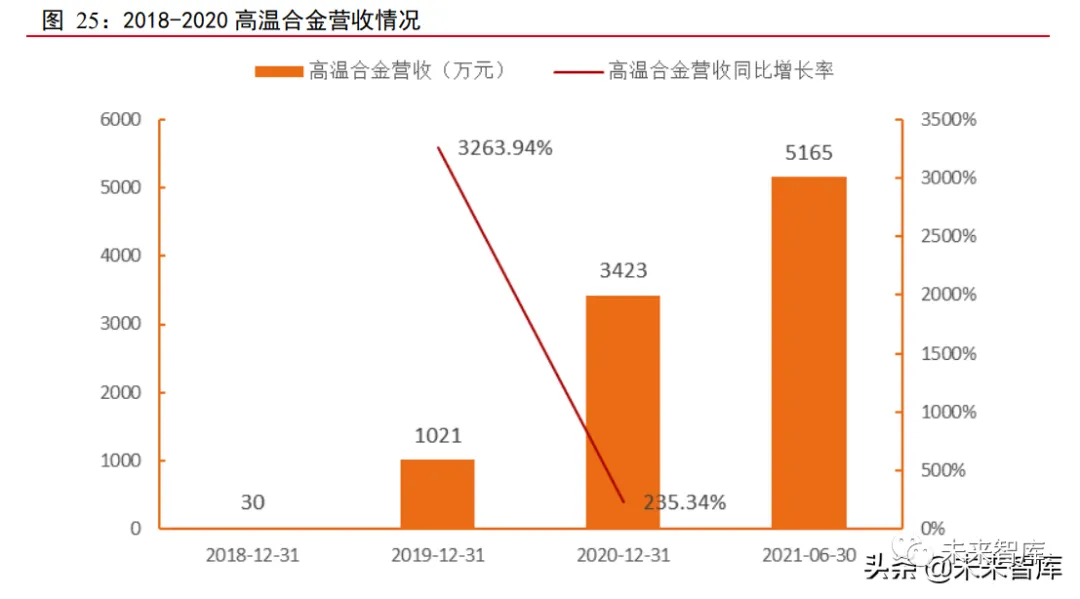

The company invested in the construction of the "Two Machines" special high-performance high-temperature alloy rod project in 2014, starting the process of engineering research on high-performance high-temperature alloys. It was put into operation in 2018 and has achieved a small amount of income. In recent years, relying on the production system and customer relationships formed in the industrialization process of high-end aviation titanium alloys, the market has been further expanded. In the first half of 2021, the high-temperature alloy material achieved a revenue of 51.65 million yuan, an increase of 515.2% year-on-year. The company raised funds in 2019 and 2022 to construct industrialization projects for high-performance high-temperature alloy materials and powder trays, as well as high-performance metal materials for aerospace. It is expected to increase production capacity by 4000 tons per year after reaching full capacity.

4.2.2 Significant economies of scale and continuously improving profit margins

The company's revenue increased from 970 million yuan to 2.11 billion yuan from 2017 to 2020, with a CAGR of 29.8%; The net profit attributable to the parent company increased from 140 million yuan to 370 million yuan, with a CAGR of 37.7%. In 2021, benefiting from the expansion of sales volume, improvement of production capacity utilization, driving economies of scale, and the absence of significant cost growth during the period, the company's revenue and net profit attributable to shareholders have further increased. The company expects a revenue of 2.93 billion yuan, a year-on-year increase of 38.9%, and a net profit attributable to shareholders of 740 million yuan, a year-on-year increase of 100.4%.

The gross profit margin for the first three quarters of 2021 was 43.3%, an increase of 6.8 percentage points year-on-year; The sales net profit margin was 25.8%, an increase of 8.1 percentage points year-on-year. Both indicators indicate that the company's profitability is gradually improving. The three expenses have remained stable with a slight decrease, and research and development investment continues to be at a high level. The management expense ratio showed a downward trend from 2018 to 2021, and the company's management efficiency gradually improved; The sales expense ratio and financial expense ratio are basically stable, with a slight decrease in the first three quarters of 2021. In 2019, the R&D expense ratio reached 9.8%, mainly invested in aircraft structural components, titanium alloys for engines, 80MN forging process research, superconducting wire preparation, high-temperature alloy melting process research, and aircraft engine applications. In the first three quarters of 2021, R&D investment was also increased, with R&D expenses of 126 million yuan,

Backed by the Northwest Research Institute of Nonferrous Metals, the company has formed an innovative technical team with several academicians as consultants and dozens of senior experts in rare metal material processing as the core, led by Zhang Pingxiang, chairman of the board of directors and academician of the CAE Member. The company has a strong state-owned enterprise background and rich technology accumulation. The company is currently a leading supplier of high-end titanium alloy materials for domestic aviation, and has been focusing on high-temperature alloy business in recent years. In the future, benefiting from the development of advanced engines, nuclear power, gas turbines and other industries, as well as the increasing demand for military equipment in China, Western Superconductor, as a company that provides two major backbone materials for military aviation engine manufacturing, can expect to benefit.

4.3 Steel Research Gaona: Complete product categories, creating a world-class platform

Gangyan Gaona is one of the most advanced enterprises in the field of high-temperature alloys in China, with the most complete range of production types. It has the technology and ability to produce more than 80% of domestic high-temperature alloys. Its products cover all segmented fields of high-temperature alloys, and multiple segmented products dominate the market. It is also an important research and development production base for industries such as aviation, aerospace, weapons, ships, and nuclear power in China.

4.3.1 After 60 years of deep cultivation, our products cover various sub fields

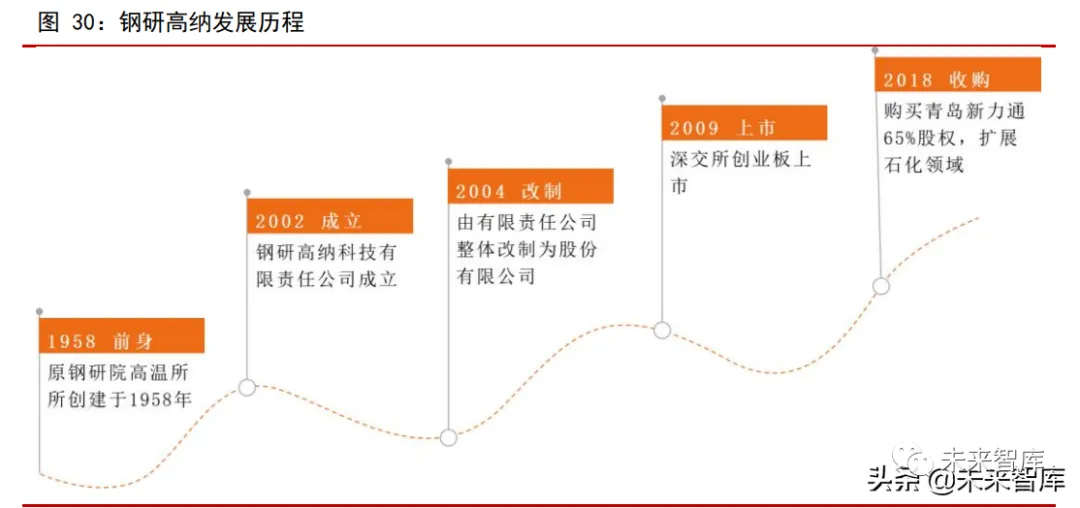

The company was established on the basis of the High Temperature Institute of the former Steel Research Institute, which was founded in 1958 and is one of the earliest units in China engaged in research on high-temperature alloys. Established as an enterprise in 2002, it inherited the assets, personnel, and technology of the Steel Research Institute and industrialized it based on its research and development. It has developed a series of high-temperature alloy products suitable for various fields. In 2004, the company was restructured from a limited liability company to a joint-stock limited company. In December 2009, it was listed on the Shenzhen Stock Exchange. In 2018, the company acquired Qingdao Xinlitong Company, a leading high-temperature alloy company in the chemical industry. The addition of Xinlitong opened up a channel for the company to enter the vast petrochemical market and improved its profitability.

The company's products are positioned in the high-end and new high-temperature alloy field, targeting mainly aerospace engine equipment manufacturing enterprises and large power generation equipment enterprise groups. At the same time, it also sells hot end components for high-temperature environments to enterprises in metallurgy, chemical industry, glass manufacturing and other fields.

The main business scope covers three sub areas: casting high-temperature alloys and products, deformation high-temperature alloys and products, and new high-temperature alloy material series products. Since its establishment, more than 120 types of high-temperature alloys have been developed. Among them, there are more than 90 types of deformed high-temperature alloys and more than 10 types of powder high-temperature alloys, both accounting for over 80% of this type of alloy in China. Among the 201 grades included in the latest publication of the "China High Temperature Alloy Handbook", the company and its predecessors led the research and development of 114 grades, accounting for 56% of the total number of grades.

The company's casting of high-temperature alloys has the advantage of mass production, while its deformation high-temperature alloys and new high-temperature alloys have technological advantages. The company's casting of high-temperature alloys is mainly used to manufacture high-temperature alloy precision castings for hot end components of aerospace engines. It has the ability to deliver and produce in bulk in its core competitive field, and its revenue share has remained at around 62% since 2019. We have advanced production technology in deformation high-temperature alloy disk forgings and turbine blade protective plates, and have the ability to manufacture powder high-temperature alloys and ODS alloys urgently needed for advanced aviation engines. The successfully developed powder high-temperature alloy disk forgings such as FGH4091, FGH4097, FGH4098 meet the design and application requirements of multiple key models of aviation engines in China.

4.3.2 Subsidiaries of civilian products bring new growth momentum

Benefiting from the synergies brought by acquisitions, the company's performance has grown rapidly in recent years. The CAGR of revenue and net profit attributable to shareholders from 2017 to 2020 were 32.5% and 49.4%, respectively. The acquisition of Xinlitong at the end of 2018 brought new profit growth points to the company, and the revenue growth rate in 2019 reached as high as 62.1%. Affected by COVID-19, the growth rate declined briefly in 2020, and resumed the trend of rapid growth in 2021. The revenue in the first three quarters was 1.43 billion yuan, with a year-on-year growth of 33.4%; Achieve a net profit attributable to the parent company of 250 million yuan, a year-on-year increase of 94.8%.

In order to better meet the growing demand for high-temperature alloys in the future civilian product field, the company has built a 45000 square meter factory in Xinlitong to further improve its production efficiency. The company's business is expected to continue to grow rapidly. Since 2017, the gross profit margin and net profit margin have steadily increased, and profitability has continued to improve. The technology of new high-temperature alloys, especially powder alloys, is becoming increasingly mature, and the powder yield is improving. Some models are gradually achieving mass production, and economies of scale are beginning to emerge.

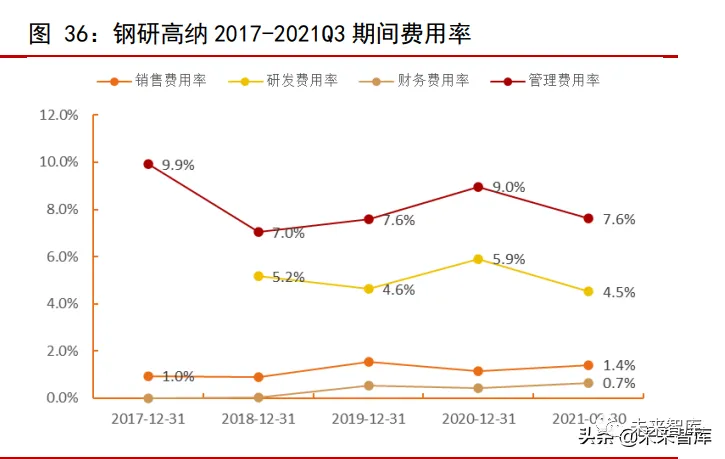

The company continues to increase its research and development efforts around the layout of the industrial chain. In 2020, R&D investment reached 115 million yuan, a year-on-year increase of 66.1%. The sales expense ratio and financial expense ratio remained relatively stable, while the management expense ratio decreased by 1.57% year-on-year in the first three quarters of 2021.

The company has a leading and technologically advanced position in multiple sub sectors of domestic aviation, aerospace, and gas turbine high-temperature alloys, and has established stable customer relationships through long-term cooperation, laying a solid foundation for the company's sustainable development. And the company's development vision is to become a world-class supplier of new metal materials and products required for high-end equipment manufacturing industry. In recent years, it has actively expanded its industrial chain upstream and downstream and horizontally.

In the future, with the increasing demand for high-temperature alloys in the two machine field and further expansion in the civilian product field, the company can maintain and enhance its leading position, and is expected to become a platform enterprise with the same competitiveness as the Precision Casting Company (PCC) in the United States.

4.4 Tunan Corporation: Core supplier of mother alloys and precision castings

Tunan Co., Ltd. is currently one of the few domestic enterprises that has both military and civilian qualification certification, and has the industrial production capacity to produce high-temperature alloy master alloys, precision castings, and deformed high-temperature alloy products throughout the entire industry chain. The company has advanced equipment for special smelting, precision casting, and pipe making, and has established a full industry chain production process for special smelting, forging, hot rolling, drawing, and casting. It independently produces high-performance special alloy materials such as high-temperature alloys, precision alloys, and special stainless steel, and forms a relatively complete product structure of bars, wires, pipes, castings, etc. through cold and hot processing technology. The products are applied in military and high-end civilian fields including aviation engines, gas turbines, nuclear power equipment, etc.

4.4.1 Military civilian integration, seizing market opportunities

The predecessor of the company, Precision Alloy Factory, was established in May 1991. In December 2007, the Precision Alloy Factory was collectively restructured into Precision Alloy Factory Co., Ltd. In January 2015, it was renamed as Jiangsu Tunan Alloy Co., Ltd. On July 23, 2020, it was listed on the Growth Enterprise Market of the Shenzhen Stock Exchange.

From the development process of technology and products, the company's business growth can be divided into four stages, from initial exploration to achieving mass production. Shortly after its establishment, the company focused on the technological content and product added value of high-temperature alloys, and began research and trial production of high-temperature alloys in 1994. After years of arduous operation and profound technical accumulation, multiple models of products have successfully passed user verification and entered the stage of mass procurement and production.

The company adapts to and expands the market with its product characteristics of "specialization, precision, and uniqueness". Its main products are high-performance alloy materials such as cast high-temperature alloys, deformed high-temperature alloys, and special stainless steels. Among them, high-quality high-temperature alloys and special stainless steel seamless pipes for aviation have occupied a certain market share. At the same time, with the industrialization of advanced technology, the variety of high-temperature alloys prepared has gradually increased, and more than 30 varieties of alloy materials and multi specification casting products have been formed, including cast high-temperature alloy series K4648, K424, K4169, K403, and deformed high-temperature alloy series GH4080A, GH4169 (IN718), GH2132 (A286), GH3625, etc. The complete product structure has achieved mass production and supply in industries such as aviation and nuclear power.

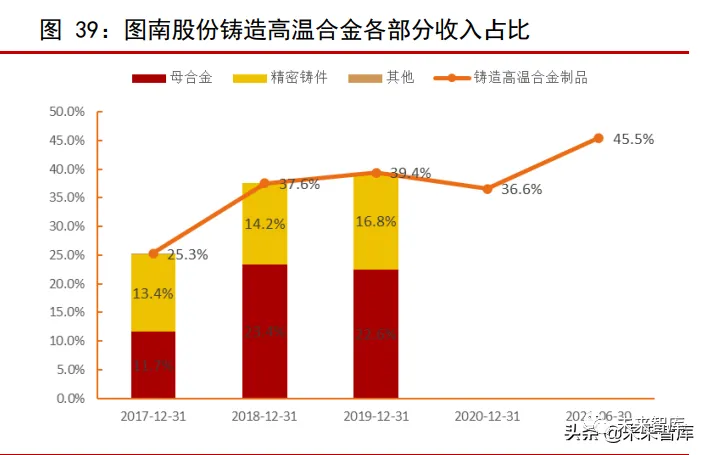

The company is one of the few domestic enterprises that produces both casting high-temperature alloy master alloys and large-scale high-temperature alloy complex thin-walled precision castings. In recent years, the proportion of revenue from the company's casting of high-temperature alloys (parent alloys, precision castings) has rapidly increased, rising from 25.3% in 2017 to 45.4% in the first half of 2021. (Report source: Future Think Tank)

4.4.2 Expanding high value-added businesses and increasing profitability

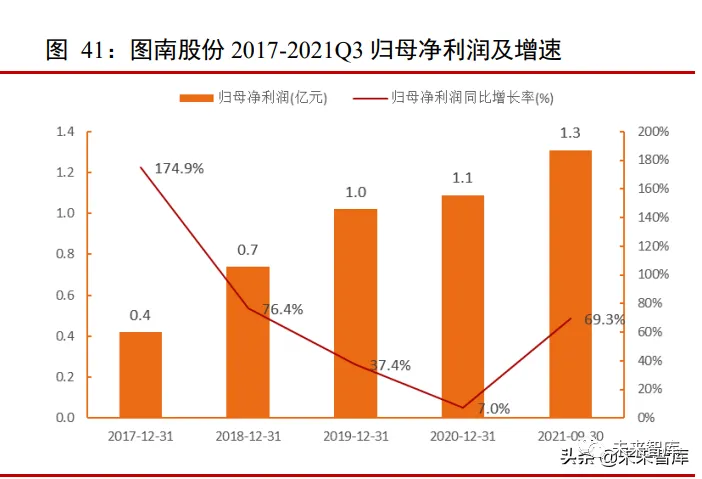

With multiple models of products entering the mass production stage, the company has experienced significant growth. Since 2015, the company has participated in the development of multiple models of precision castings, which have successfully passed user verification and entered the mass production stage. From 2017 to 2020, the revenue increased from 350 million yuan to 550 million yuan, with a CAGR of 16.3%; The net profit attributable to the parent company increased from 42.08 million yuan to 110 million yuan, with a CAGR of 37.4%. According to the 2021 performance forecast, it is expected to achieve a net profit attributable to the parent company of RMB 169-185 million, an increase of 54.9% -69.6% year-on-year. In the future, with the gradual replacement of related product models, weapons and equipment, the company's business will continue to grow steadily.

The improvement of product structure has led to a continuous increase in the company's profitability. The company continues to increase the sales revenue and proportion of high-tech and high value-added products such as casting high-temperature alloys and special stainless steels, resulting in an increase in profit levels. In the first half of 2021, the company's sales revenue from casting high-temperature alloys increased from 25.3% in 2017 to 45.4%, with a gross profit margin of 50.7%; The sales revenue of deformed high-temperature alloys accounts for 26.9%, with a gross profit margin of 30.8%, and the gross profit margin of special stainless steel is also as high as 44.1%. The company has a leading technological advantage in the field of complex thin-walled structural components such as casings, and will continue to benefit from the iteration of new model technology and domestic substitution.

Since 2017, the cost rate has been decreasing year by year, and lean management has been effective. The first half of 2021 was mainly due to the implementation of equity incentive plans, confirmation of share based payment expenses, and an increase in management expense ratios. The decrease in financial expense ratio is particularly significant, dropping from 4% in 2017 to 0.45% in 2020. The company has increased its R&D investment again since 2019, and the R&D expense ratio reached as high as 6.2% by 2020. The company is simultaneously carrying out nearly 20 research and development projects, involving the research and development of technologies and products such as casting high-temperature alloy master alloys, precision castings, deformed high-temperature alloys, pipes, etc., which is conducive to continuously expanding the product chain, improving product quality, and achieving import substitution.

The company has a complete industrial chain, high stability of downstream customers, and simultaneous development of military and civilian businesses, with great certainty of benefits. After years of steady operation, the company has accumulated rich customer resources in both military and high-end civilian fields with reliable product quality and leading technological strength. Customers occupy a market advantage in their respective industries, and stable and predictable product demand provides reliable guarantees for the company's future business development. At the same time, the construction of the production capacity of the entire industry chain and the "one resource input, two benefit outputs" of military civilian integration have more effectively ensured the high quality and production efficiency of products and achieved win-win development. With the rapid growth of demand in China's aerospace industry and the acceleration of domestic substitution, the company can better benefit from the vast growth space of the high-temperature alloy market.